The most effective way to get the cheapest Nissan Leaf insurance is to do a yearly price comparison from companies in Colorado Springs.

The most effective way to get the cheapest Nissan Leaf insurance is to do a yearly price comparison from companies in Colorado Springs.

- Step 1: Get an understanding of what coverages are included in your policy and the measures you can control to keep rates low. Many factors that cause high rates such as your driving record and a negative credit score can be rectified by paying attention to minor details. Keep reading for more information to help prevent high rates and find hidden discounts.

- Step 2: Request rate estimates from direct carriers, independent agents, and exclusive agents. Direct companies and exclusive agencies can only give prices from one company like Progressive or State Farm, while independent agencies can provide rate quotes for a wide range of insurance providers. Select a company

- Step 3: Compare the quotes to your existing rates and see if there is a cheaper rate. If you find better rates, ensure there is no coverage lapse between policies.

A key point to remember is to try to compare identical coverages on every quote request and and to analyze as many auto insurance providers as possible. This guarantees a fair price comparison and a complete price analysis.

It’s well known that auto insurance companies don’t want you to look for cheaper rates. Drivers who shop around are inclined to buy a new policy because of the high probability of finding a more affordable policy. A recent study showed that drivers who routinely compared rates saved $850 each year compared to those who don’t regularly compare prices.

If finding the lowest price for Nissan Leaf insurance in Colorado Springs is your intention, knowing how to find companies and compare coverage rates can make it easier for you to save money.

If you already have coverage, you will most likely be able to reduce the price you pay using the following tips. Locating the best rates in Colorado Springs is actually quite easy if you know where to start. Although Colorado drivers must know the methods companies use to charge you for coverage because it can help you find the best coverage.

The majority of larger companies allow you to get coverage price quotes directly from their websites. Getting quotes for Nissan Leaf insurance in Colorado Springs is very simple because it’s just a matter of typing in the coverages you want into the form. After you complete the form, the company’s rating system makes automated requests for your credit score and driving record and generates a price. Quoting online for Nissan Leaf insurance in Colorado Springs simplifies rate comparisons, and it is imperative to compare as many rates as possible if you want to find the cheapest price on insurance.

In order to compare rates using this form now, check out the insurance providers below. To compare your current rates, we recommend you complete the form with the limits and deductibles identical to your current policy. Using the same limits helps guarantee you will have an apples-to-apples comparison based on identical coverages.

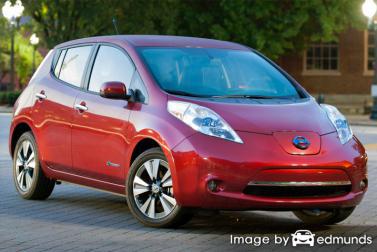

The car insurance companies shown below are ready to provide price quotes in Colorado. To get cheap car insurance in Colorado Springs, we recommend you get price quotes from several of them in order to find the most affordable rates.

Learn How to Lower Your Insurance Costs

Many different elements are used in the calculation when you get your auto insurance bill. A few of the factors are predictable like a motor vehicle report, but some are less apparent such as your marital status or how financially stable you are. It’s important that you understand a few of the rating criteria that come into play when calculating your premiums. If you have a feel for what positively or negatively impacts your premiums, this enables you to make decisions that will entitle you to much lower annual insurance costs.

- Theft deterrents systems cut rates – Choosing a vehicle with an alarm system can help lower your premiums. Anti-theft devices such as tamper alarm systems, vehicle immobilizer technology and General Motors OnStar all hinder car theft.

- Minor frequent car insurance claims are not good – Auto insurance companies in Colorado award the lowest premiums to people who do not file claims often. If you file claims often, you can look forward to either policy cancellation or increased premiums. Insurance coverage is intended for the bigger claims that can’t be paid out-of-pocket.

- Men drivers tend to cost more – The statistics show that men are more aggressive behind the wheel. That doesn’t necessarily mean that females are better at driving than males. Females and males tend to get into at-fault accidents in similar numbers, but males tend to have more serious accidents. Not only that, but men also have more aggressive citations such as DWI and reckless driving.

- Save money with high credit – Having a bad credit score will be a significant factor in determining your rates. Consumers who have excellent credit tend to be less risk to insure as compared to drivers with poor credit. So if your credit is not that good, you could pay less to insure your Nissan Leaf by improving your rating.

- Pay more if you have a long commute – Having an address in a small town may provide you with better prices when talking about car insurance. Fewer people corresponds to lower accident rates and lower theft and vandalism rates. People who live in big cities regularly have congested traffic and higher rates of accident claims. Spending more time driving means a statistically higher chance of an accident.

- Liability protection is important – Your policy’s liability coverage will protect you when you are found liable for causing personal injury or damage in an accident. Your policy’s liability insurance provides for a legal defense up to the limits shown on your policy. This coverage is relatively inexpensive compared to comp and collision, so drivers should carry high limits.

- Having a spouse can lower costs – Your spouse may cut your premiums compared to being single. Having a significant other generally demonstrates drivers are less irresponsible it has been statistically shown that married drivers tend to have fewer serious accidents.

- Driver age impacts premiums – Young drivers in Colorado are proven to be less responsible in a vehicle so car insurance rates are higher. Older people have been proven to be more responsible, tend to cause fewer accidents, and tend to be get fewer driving tickets.

-

Nissan Leaf insurance loss statistics – Insurance companies take into consideration historical loss data for every vehicle to help determine costs. Models that statistically have high amounts or severity of claims will have a higher cost to insure.

The table shown below demonstrates the collected loss data for Nissan Leaf vehicles. For each insurance policy coverage type, the claim amount for all vehicles, regardless of manufacturer or model, is a value of 100. Values that are below 100 indicate better than average losses, while percentage values above 100 indicate more frequent claims or a tendency for claims to be larger.

Nissan Leaf Insurance Loss Statistics Vehicle Model Collision Property Damage Comp Personal Injury Medical Payment Bodily Injury Nissan Leaf Electric 89 84 45 83 64 76 BETTERAVERAGEWORSEStatistics from IIHS.org for 2013-2015 Model Years

It may be expensive, but it’s not optional

Despite the high cost, insuring your vehicle may be mandatory for several reasons.

- Most states have mandatory insurance requirements which means it is punishable by state law to not carry specific minimum amounts of liability insurance if you drive a vehicle. In Colorado these limits are 25/50/15 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $15,000 of property damage coverage.

- If you took out a loan on your Nissan Leaf, more than likely the lender will require you to buy insurance to guarantee loan repayment. If the policy lapses, the lender may have to buy a policy to insure your Nissan at a much higher premium rate and force you to pay the higher price.

- Insurance preserves both your Nissan and your assets. Insurance will also pay for most medical and hospital costs for yourself as well as anyone injured by you. As part of your policy, liability insurance will also pay for a defense attorney if you are sued as the result of your driving. If you receive damage to your vehicle caused by a storm or accident, your insurance policy will pay to restore your vehicle to like-new condition.

The benefits of having insurance are definitely more than the cost, especially if you ever need it. As of last year, the average driver in Colorado is wasting up to $820 a year so you should quote and compare rates at least once a year to make sure the price is not too high.